What is Banking and Finance App Development?

Banking and finance app development is a specialized procedure of building digital apps that allow financial institutions and businesses to provide comprehensive banking services through mobile and web platforms.

This complex technological solution integrates advanced security protocols, complex financial functionalities, and user-focused interfaces in order to deliver smooth digital banking experiences, enabling users to manage accounts, track investments, access financial services, and make transactions, anytime, and anywhere.

Benefits of Banking and Finance App Development

Digital financial solutions are transforming how individuals and businesses manage money, offering unparalleled convenience, accessibility, and security through advanced technological innovations. The most crucial benefits of banking and finance app development are explained below comprehensively:

1. Enhanced Customer Experience

Mobile finance applications provide 24/7 access to financial services that eradicate traditional banking constraints. Users can perform transactions, manage investments, and check balances quickie from anywhere.

This minimizes wait times and provides personalized financial insights through intuitive interfaces.

2. Cost-Efficient Operations

Digital platforms reduce operational expenses by reducing physical infrastructure and manual processes.

Automated systems simplify transactions, enable financial institutions, and reduce human error in order to offer competitive services while maintaining lower overhead costs.

3. Advanced Security Measures

Complex authentication technologies like multi-factor authentication, biometrics, and encryption protect sensitive financial data.

Real-time fraud detection algorithms and secure payment gateways ensure comprehensive protection against unauthorized access and financial cyber threats.

4. Data-Driven Financial Insights

Intelligent analytics process transaction data in order to generate financial recommendations.

Machine Learning algorithms allow users to understand spending patterns, make informed investments, predict financial trends, and make budgeting decisions.

5. Scalable Financial Services

Digital platforms allow quick integration of the latest financial services and technologies.

Modular architectures enable the smooth addition of features like international payments, cryptocurrency support, and evolving financial technologies without complete system re-design.

What Are The Device Requirements For Using The App?

The banking and finance app supports modern smartphones and tablets running iOS 13+ and Android 9.0+.

Devices must have a minimum of 4GB RAM, reliable internet connectivity, and the latest system updates. Recommended screen sizes range from 5 to 7 inches for optimal user experience and interface readability.

How Does The Banking and Finance App Work?

The baking and finance app connects securely with financial institutions through encrypted APIs, authenticating users via biometric or multi-factor verification.

It retrieves real-time account information, provides comprehensive financial management tools, and processes transactions.

Advanced algorithms examine spending patterns, offer personalized financial recommendations, and generate insights through an intuitive and user-friendly interface.

Key Features of Banking and Finance App Development

Modern financial apps integrate robust technologies in order to provide secure, comprehensive, and user-centric digital banking experiences that transform traditional financial management approaches. These crucial features are explained below:

1. Secure User Authentication

Implement multi-layered security protocols including biometric login, two-factor authentication, and advanced encryption.

Utilize facial recognition, fingerprint scanning, and dynamic password systems to ensure maximum account protection. Provide multiple secure login options for user convenience and robust identity verification.

2. Real-Time Transaction Monitoring

Develop comprehensive transaction tracking systems with instant notifications and detailed analytics. Provide users with immediate insights into spending patterns, account activities, and potential fraudulent transactions.

Implement machine learning algorithms to detect unusual financial behaviors and alert users proactively.

3. Digital Wallet Integration

Create seamless payment solutions supporting multiple payment methods and digital wallet technologies. Enable quick transactions, store payment information securely, and support various payment networks.

Integrate cryptocurrency, traditional banking, and emerging payment technologies for comprehensive financial management.

4. Investment Portfolio Management

Develop advanced investment tracking and management tools with real-time market data integration. Provide comprehensive portfolio analysis, performance tracking, and personalized investment recommendations.

Include visualization tools, risk assessment features, and automated investment strategy suggestions.

5. Budgeting and Expense Tracking

Design intelligent financial management tools that automatically categorize expenses and provide detailed financial insights.

Implement AI-powered spending analysis, customizable budget creation, and predictive financial planning features. Generate comprehensive reports and actionable financial recommendations.

6. Customer Support Integration

Develop multi-channel customer support systems including AI chatbots, live chat, and comprehensive help resources.

Provide instant problem resolution, personalized financial guidance, and 24/7 customer assistance. Implement intelligent routing and context-aware support mechanisms.

7. Bill Payment Automation

Create automated bill payment systems with scheduled transactions and intelligent reminders.

Enable users to set up recurring payments, track billing cycles, and manage multiple payment sources. Provide comprehensive bill management and payment optimization tools.

8. Personalized Financial Insights

Implement advanced data analytics to generate personalized financial recommendations and insights.

Utilize machine learning algorithms to analyze spending patterns, predict financial trends, and offer tailored financial advice. Provide comprehensive financial health monitoring tools.

Why is Data Security Critical For Financial Apps?

FinTech or Financial Technology applications manage sensitive personal and financial information, making vigorous data security paramount. Cyber threats, data breaches, and financial fraud can cause devastating reputational and financial damage.

Advanced encryption, continuous security monitoring, and multi-factor authentication are crucial to safeguard users’ confidential financial data.

Different Platforms For Banking and Finance App Development

Financial apps require strategic platform selection in order to ensure maximum accessibility, user experience, and performance across diverse technological ecosystems. Different platforms for which banking and finance apps are developed are explained below:

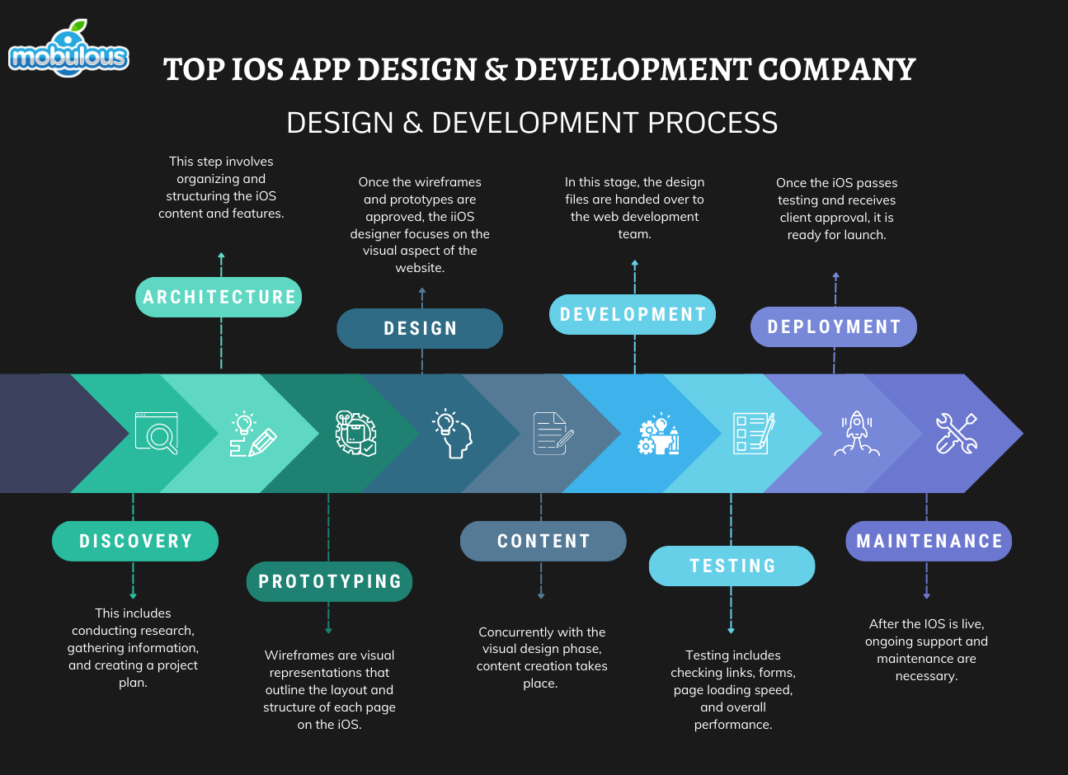

1. iOS App Development

iOS application development is achieved by leveraging Swift or Objective-C programming languages and Apple’s robust development ecosystem.

Leverage iOS-specific security features, ensure seamless integration with the Apple ecosystem, optimize performance for Apple devices, and enforce rigid App Store compliance protocols.

2. Android App Development

Android application development is achieved through Java and Kotlin programming languages, optimizing for multiple Android device specifications.

Enforce comprehensive security measures, ensure performance across diverse smartphone and tablet configurations, and support different Android versions. Develop apps for Google Play Store requirements.

3. Web App Development

Responsive web application development is done by using modern front-end and back-end technologies and implementing progressive web app (PWA) technologies for cross-device compatibility.

Ensure powerful security, comprehensive functionality accessible, and fast loading times through web browsers across multiple platforms.

4. Cross-Platform App Development

Leverage frameworks like React Native and Flutter in order to create unified apps across different platforms.

Build single codebase solutions that work seamlessly on iOS, Android, and web platforms. Optimize cross-platform app development efficiency and maintain consistent user experience across a wide range of devices.

How Does The App Help Improve Overall Financial Literacy?

The banking and finance app development serves as an educational tool that provides users with detailed financial insights and interactive learning experiences.

Advanced analytics break down sophisticated financial concepts, help users understand budgeting, and offer personalized spending recommendations, financial planning, and investment strategies through intuitive visualizations and real-time interpretation.

What Payment Options Are Supported Within The App?

Banking and finance app development and other digital payment platforms now offer multiple transaction methods that allow seamless and protected financial interactions across diverse payment channels and user preferences. Some of the most essential payment options supported within the application are mentioned below:

1. Credit and Debit Card Payments: Quick card-based transactions are done by using major network providers.

2. Mobile Wallet Integration: Seamless payments are done through Apple Pay and Google Pay.

3. Bank Transfer Capabilities: Direct bank account transfers are done with secure authentication.

4. Cryptocurrency Transaction: It supports digital currency payments using blockchain technology.

5. QR Code Payment Method: Instant scan-and-pay transaction processing system.

6. Contactless NFC Payments: Tap-to-pay technology for quick transactions.

How Can Users Integrate The App With Third-Party Financial Tools?

Modern financial ecosystems demand interconnected platforms that alow for smooth data sharing, enhanced user experience, and extensive financial management across different services. Steps to integrate the app with third-party financial tools are mentioned below:

1. Open Banking API Integration

Develop standardized API connections allowing secure data exchange between multiple financial institutions. Enable users to aggregate accounts from different banks, credit cards, and financial services. Implement robust authentication protocols ensuring data privacy and regulatory compliance.

2. Investment Platform Synchronization

Create comprehensive integration mechanisms with popular investment platforms and stock trading applications. Allow automatic portfolio synchronization, real-time market data updates, and consolidated investment tracking. Implement secure authentication and data transfer protocols.

3. Accounting Software Connection

Design seamless integration with accounting software like QuickBooks and Xero. Enable automatic transaction categorization, financial reporting, and expense tracking. Provide comprehensive data synchronization and reconciliation features for business and personal financial management.

4. Expense Management Tool Integration

Develop connections with expense management platforms for comprehensive financial tracking. Enable automatic expense categorization, receipt scanning, and detailed financial reporting. Implement machine learning algorithms for intelligent expense analysis and optimization.

5. Credit Score Monitoring Services

Integrate with credit monitoring platforms to provide comprehensive financial health insights. Enable automatic credit score tracking, detailed financial analysis, and personalized improvement recommendations. Implement secure data-sharing protocols.

6. Budgeting and Financial Planning Tools

Create robust integrations with personal financial management and budgeting applications. Enable automatic budget tracking, goal setting, and financial forecasting. Implement intelligent recommendation systems for financial optimization.

7. Cryptocurrency Wallet Synchronization

Develop secure integration mechanisms with cryptocurrency tracking and trading platforms. Enable real-time portfolio tracking, transaction synchronization, and comprehensive digital asset management. Implement advanced security protocols for cryptocurrency data exchange.

Industry Diversified

Industry Diversified