Techfin vs fintech technologies are the terms that are in utmost demand nowadays. Well, TechFin revolves around technology companies that are going to enter the financial sector in order to provide ingenious solutions whereas Fintech is a financial technology that primarily concentrates on enhancing financial services.

You should keep in mind that fintech primarily concentrates on enhancing financial services whereas techfin revolves around financial technology companies that are going to enter the financial sector to provide ingenious solutions.

This involves utilizing their current technological infrastructure and user base for delivering financial services or incorporating financial functionalities into their pre-existing platforms. Tech fin firms are considered the Beyoncé of personal finance apps, pitching down with next-level technology and enormous user bases.

Although their names might sound similar but you should know that their approaches and objectives differ greatly. So, without wasting a minute, let’s begin with our today’s blog revolving around financial technology or finance tech.

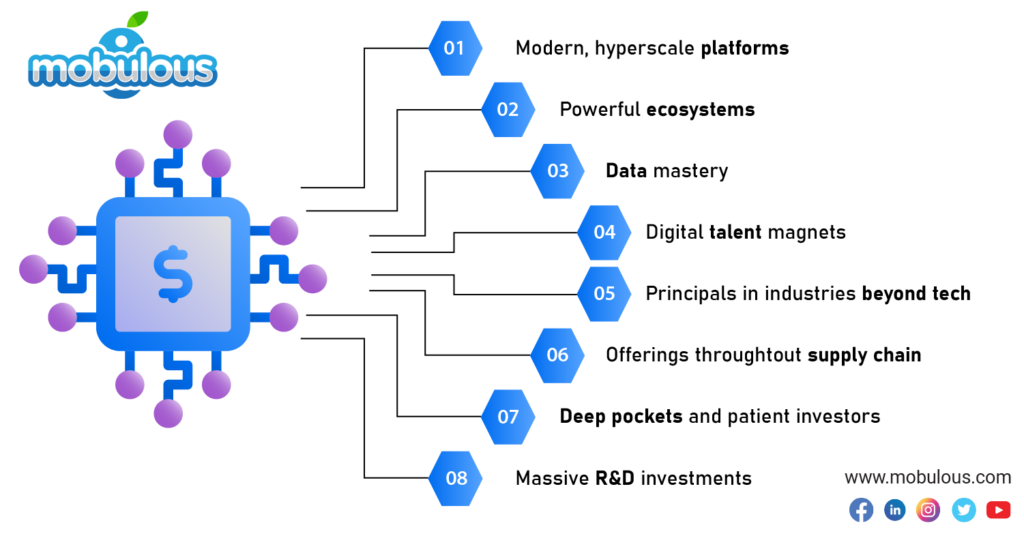

What Does Techfin Stand For?

Techfin is a mixture of technology and finance that describes the approach of technological companies that are entering the financial sector to provide innovative and ingenious solutions. It specifically means, “Techfin = Technology + Finance.”

You will be able to understand when we break the two concepts and elaborate it proactively for you, i.e., technology and finance. Have a look below:

- Technology: It refers to contemporary software, platforms, analytics, and other IT capabilities that have been leveraged by these savvy financial technology companies.

- Finance: It refers to the financial products, services, and functionalities that these tech-savvy firms provide to their consumers, integrating their technological capabilities.

This simple term highlights finance technology where technology companies withhold their expertise, infrastructure, and resources in order to deliver a wide variety of financial products and services to customers and businesses.

However, tech-fin is more of a descriptive term that is used to categorize firms that are primarily tech enterprises but are going to enter the financial sector by delivering financial services alongside their core offerings.

Let’s take some examples to help you further demonstrate on this particular topic:

- Tech companies: Apple, Google, Amazon, Facebook.

- Finance offerings: Payments, investing, lending, asset management, personal finance tools.

- Examples of Techfin Company: Apple Pay, Google Wallet, Amazon Lending, and Robinhood.

Also Check:- TechFin: What is TechFin?

What Does Fintech Stand For?

Fintech is another term that refers to businesses that use technology in order to deliver financial services. It specifically directs to the usage of technology in order to deliver and enhance financial services.

Fintech technologies confines a wide range of apps which includes mobile payments, online banking, cryptocurrency, robo-advisors, peer-to-peer lending, and several others.

Fintech companies leverage progression in technology, including AI, blockchain, and big data analytics in order to create ingenious solutions that improve the accessibility, affordability, and efficiency of financial services.

It combines finance and technology to reshape how people and enterprises collect and handle money. Let’s take a closer look at this concept in order to help you out in a broader way.

- Provide Services in Domains Like: Banking, investments, lending, fundraising, payments, personal finance, etc.

- Main Goal: To make financial services more efficient, affordable, suitable, and customizable through technology.

- Example of Fintech Companies: PayPal, Square, Robinhood, Coinbase, Affirm, SoFi, and Credit Karma among others.

For Any Query: Seek help & Guidance from Finance App Development Company!

Techfin vs Fintech: Key Differences

In order to get more detailed information regarding the two, i.e., fintech and techfin, you need to consider the table below. The key differences explained under will help you a lot in order to gain a broader understanding of the concept in a better way.

| Categories | Techfin | Fintech |

| Origins | Techfin is instituted by a considerable technological firm that develops and extends its products and services into financial offerings leveraging its existent user base and tech abilities. | Fintech is instituted from within the industry of financial services. It is basically for startups who try to enhance and modernize financial services and baking with the help of software and analytics. |

| Offerings | Techfin delivers financial services alongside a more comprehensive suite of tech products and services. The financial offerings sustain their prior business. | Fintech concentrates mainly on innovating typical financial products and services that include payments, investing, lending, personal finance management tools, crypto/blockchain services, and several others. |

| Approach | Techfin delivers financial services in order to support its preceding technology ecosystems and maintain users within them. The tech platform is still the center focus in this context. | Fintech strives to disrupt distinctive legacy financial strategies with an emphasis and focus on more eminent efficiency, accessibility, and user-centricity. |

| Technology Focus and Utilization | Techfin integrates financial offerings alongside existing and current technologies like cloud, AI/ML, platforms, and internet services that support and sustain its other products. | Fintech creates targeted software, algorithms, and analytics to enhance the delivery of detailed financial functions. Financial DNA is at the core of this particular context. |

| Regulations and Compliance Standards | Techfin encounters more nominal regulation presently as financials are peripheral to center-tech services. But it is most likely to entice more scrutiny going ahead. | Fintech manages to face more strict and rigorous regulations as it concentrates exclusively on restrained financial services. |

Techfin vs Fintech: Areas of Similarities

Get a piece of more detailed information on the areas of similarities between techfin and fintech with the table given below. This table will help you a lot in gaining knowledge before applying it in your startup.

| Categories | Similarities Between Techfin and Fintech | |

| Utilization of Modern Technology |

|

|

| The Goal of Accessibility and Inclusion |

|

|

| Disrupting Traditional Finance |

|

|

| User-Friendly Experiences |

|

|

| Efficient Processes |

|

|

Opportunities and Challenges in Techfin vs Fintech

There are certain opportunities and challenges in the field of techfin and fintech. Want to know more about it? Let’s delve deeper into the realm of fin technology and tech finance and learn all about what opportunities and challenges this concept upholds dynamically.

Opportunities in Techfin vs Fintech

The financial world is filled with innovation and is ready to welcome more in this context. You should know that both fintech and techfin offer exciting opportunities. Let’s dive deeper and understand about this in a better way.

1. Growth potential

You should keep in mind that both techfin and fintech have been envisioned to continue robust growth trajectories as digital financial services keep on progressing in popularity and maturity.

Their innovative and ingenious solutions have a tremendous addressable financial market on a global level.

2. Partnership Opportunities

As you know techfin and fintech continue to disrupt the conventional finance market and are ready to commence disrupting each other to some extent, partnership opportunities emerge in order to combine technological strengths and consumer bases.

Under this concept, joint resolutions and solutions also encounter lower regulatory burdens and limitations in several areas.

3. Mainstream Adoption

Mainstream adoption is another opportunity under the techfin vs fintech concept where digital financial solutions are primed for mass customer and enterprise adoption.

For instance, there are some given factors such as smartphone penetration, faster & cheaper internet connectivity, and preference for mobile experiences. Both sets of players will be satisfied.

4. New Markets

Last but not least, new markets are ready to set another opportunity for both techfin and fintech.

Starting from blockchain and ending on embedded finance, new technological capabilities, and evolving customer and enterprise needs will constantly expand the addressable markets.

The most awaiting yet important opportunity, i.e., New markets for both fintech and techfin is considered the most promising and exciting way.

Challenges in Techfin vs Fintech

We should keep in mind that although there are several opportunities in both fintech and techfin, we should never overlook its challenges. Everyone out there questions if this will be a gold rush for customers or tech entrepreneurs. Buckle up, partners, and learn what challenges this concept upholds.

1. Increased Competition

As you can see these segments converge, and competition will intensify between techfins, fintechs, and requisite financial technology players.

Everyone strives for the tremendously profitable financial services space, helping it to expect and raise customer acquisition costs.

2. Regulatory Uncertainty

The second challenge that encompasses techfin vs fintech is regulatory uncertainty. Questions remain around appropriate regulations as the latest offerings blur the lines between technology platforms, advisory services, financial institutions, and commerce providers.

Balance is required in order to authorize the innovation at the time of safeguarding the customers. Legal clarity is still evolving at a high pace. Not only this but also data usage, cybersecurity, and privacy rights are part of this.

3. Trust and Loyalty

When we offer incomparable ventures in numerous ways, the brand affinities of the users and their trust generally remain more assertive with legacy brands. User education, customer service, and reliable infrastructure are important.

In addition to this, with increasing trust and loyalty, partnerships expand between the conventional and new-age players in the space of finance-meets-tech.

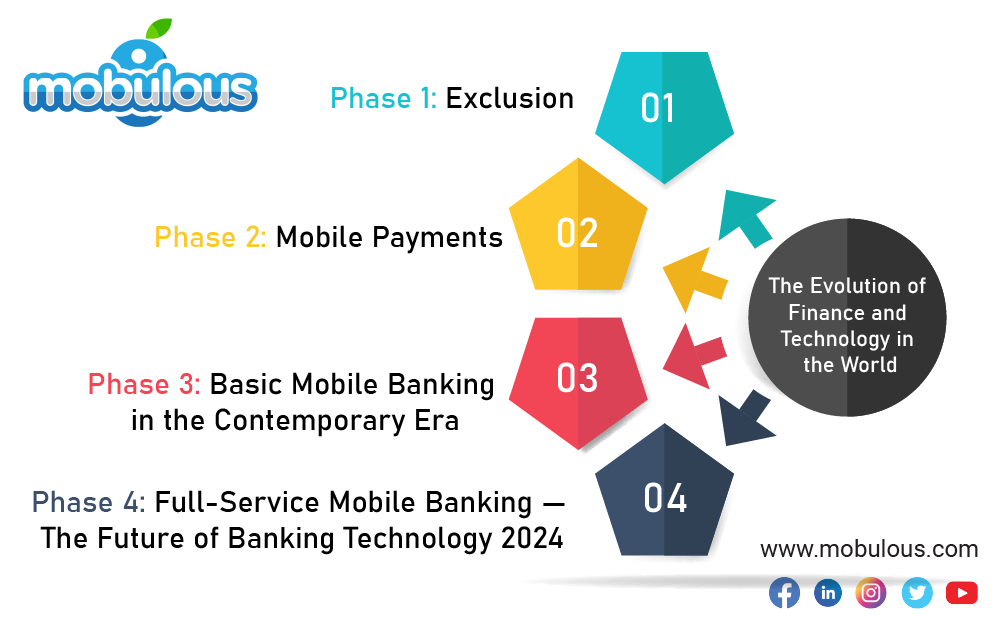

The Evolution of Finance and Technology in the World

Finance and technology are evolving at an alarming rate, bringing a stark modification in the particular context. You will agree to the fact that what finance once was in the earlier days is not something that it is now and it won’t be the same in the next coming years.

Let’s observe the movement and evolution of finance and technology in a bit more detail which includes exclusion, mobile payments, basic mobile banking in the contemporary era, and full-service mobile banking which is considered the future of banking technology from 2024 to beyond.

Also Check:- What is DeFi And How Can It Revolutionize Finance & Banking?

Phase 1: Exclusion

The first phase of finance technology evolution is the “exclusion.” In this phase, there was no technology in the ongoing picture.

Financial customers awaited a lot in long queues in banks in order to perform any and all types of money-related work.

Phase 2: Mobile Payments

The next phase of technology and finance is mobile payments. Hare, a small morset of the banking sector came on mobile banking services.

Users were most likely to stand in queues in order to make the payments of their bills, water, and electricity on mobile via apps that came excessively from non-banking institutions.

Phase 3: Basic Mobile Banking in the Contemporary Era

Seeing the alleviation that this digital revolution in finance and technology was delivering to an innumerable user base, a number of banking institutions also entered the space by building a financial application for their bank.

For the moment, non-banking technology companies also expanding their offerings and entering services like credit facilities, lending, and several others. This is the phase from where the finance industry kept its step and started emerging as the best service provider. This stage came to be known as the fintech app development world or online banking.

Phase 4: Full-Service Mobile Banking — The Future of Banking Technology 2024

Last but not least, this is the final stage of fintech and techfin evolution. Now the time is set to move from Fintech to Techfin.

Technology-based firms made an entry into banking services in order to make their existence secure and the financial institutions will start involving technology at an exceptional level in their processes.

The Bottom Line

Now, you would have understood that the financial frontier is overflowing with innovation and ingenious solutions and TechFin giants and Fintech upstarts are competing for dominance. Techfin leverages existing tech and user data, Fintech disrupts with focused and ingenious solutions.

Both of these faces shared challenges and opportunities, however, their collaboration can unlock stringent potential. With our guide on techfin vs fintech, you would have understood all that you needed to know regarding finance and technology reshaping the contemporary world.

However, if you feel you are stuck somewhere and need professional help, then make sure to contact Mobulous who can help you bountifully in this context.

Frequently Asked Questions

Q. What is Techfin?

Ans. Techfin generally means technology companies that leverage their existing technology infrastructure and expertise in order to enter the financial services industry. For illustration, Alibaba and Tencent.

Q. What is Fintech?

Ans. Fintech generally means finance technology. It simply refers to ingenious technology-driven solutions that can interrupt conventional financial services, including banking, lending, payments, and wealth management.

Q. What are some examples of Techfin companies?

Ans. Some popular examples of techfin companies include Alibaba’s Ant Group, Tencent’s WeChat Pay, Google Pay, Amazon Pay, and Apple Pay.

Q. What are some examples of Fintech companies?

Ans. Some common examples of fintech companies include PayPal (online payments), Robinhood (stock trading), Stripe (payment processing), Square (mobile payments), and SoFi (online lending and financial services).

Visit Mobulous for App Development Services

Mail