TechFin or Technology Finance is shaping a new financial landscape that is evolving at the speed of flash. Yes, we know that you are here because the term, “fin-tech” keeps popping up in your mind and you don’t exactly know what it means, isn’t it?

If you are scratching your head and pointing your eyes here and there wondering what Technology Finance is all about, then worry not folks as you are not alone. This new concept is in utmost demand in today’s competitive era.

What is Techfin?

Technology companies have rapidly expanded into offering financial services in recent years by starting a new industry named, “techfin.” Technology and finance were different industries earlier but now in recent times, we have seen increasing convergence between the two.

Some gigantic technology platforms such as Google, Apple, Amazon, and Facebook leverage their enormous consumer base and refined technical capabilities in order to provide a wide array of financial products.

These financial products include lending programs, digital payments, insurance policies, wealth management tools, and several others. And now, they strive to disrupt the financial sector similar to how they disrupted other conventional industries before. With their iOS and Android app development, Tech Fin is ready to start an upsurging roar in the future.

If you are one of those who work in the financial sector, then you must know the importance of tech fin. Technology finance presents both opportunities and challenges via potential partnerships but also competitive threats of disruptive innovation. Their big data algorithms, mobile-first distribution, and global reach give them a competitive edge.

If you search google on Techfin you will find What is Techfin ranking on 10 different lists.

What are TechFin Companies?

Tech-fin companies simply refer to large technology companies that are expanding into providing financial services that leverage their existing platforms and capabilities.

The tech fins are technology companies that have been providing software solutions that are not chiefly finance-related and now strive to launch financial services.

They already have access to consumers and massive amounts of data from their relationships with their clients. Here are some of the most common examples of tech fin companies. Let’s take a look at these techfin examples below:

- Tech Companies: Apple, Google, Amazon, Facebook.

- Finance Offerings: Payments, investing, lending, asset management, personal finance tools.

- Examples of Techfin Company: Apple Pay, Google Wallet, Amazon Lending, and Robinhood.

For Any Query: Seek help & Guidance from Finance App Development Company!

3 Types of TechFin Offerings

Techfin companies leverage their technical capabilities and vast consumer access in order to provide a wide array of financial services. Make sure to read the below-mentioned offerings of Tech-fin that will help you bountifully. Here are some of the major categories:

1. Digital Payments

Tech fins such as Google, Apple, and Amazon have built popular mobile and online payment systems incorporated with their devices, platforms, and stores. These digital payments include the following:

- Mobile Wallets (Apple Pay, Samsung Pay).

- Cross-border Remittances (Facebook Pay).

- Peer-to-Peer Payments (Messenger Pay).

- Microtransaction Systems.

2. Lending and Financing

Imposing transaction histories and consumer analytics, TechFin companies provide lending and financing which includes the following:

- Consumer Installment Loans (Affirm, Klarna).

- Micro Lending Apps.

- Small Business Loans (Amazon Lending).

- Payroll Software Integrations.

3. Investment and Wealth Management Tools

There are several tech companies that now clear the way for investing, and wealth management, including the following:

- Investing Apps (Robinhood, SoFi Invest).

- Robo-Advisors (Betterment).

- Stock Trading APIs and Analytics.

- Retirement Planning Plugins.

For Any Query:- Seek help and guidance from a Mobile App Development Company.

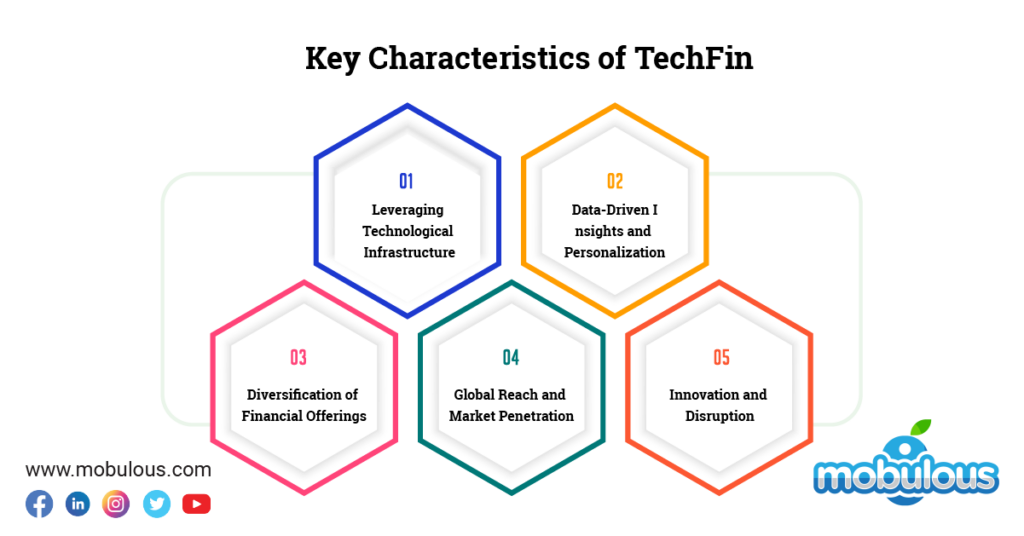

Key Characteristics of TechFin

Tech-fin can be described as a new and evolving industry that amalgamates the two when it comes to finance and technology. In short, Tech-fin describes the intersection of financial services and technology.

When talking about its core, Tech-fin is concentrated on building ingenious financial services and products fuelled by modern technology. Tech-fin companies strive to create user-friendly and efficient financial solutions to help individuals and firms solve their financial problems.

There are some of the key characteristics of a Tech-fin company that include the following. Make sure to read these characteristics in a careful manner so that you don’t overlook something.

1. Leveraging Technological Infrastructure

Tech-fin companies such as Amazon, Google, and Alibaba, harness their existing technological ecosystems in order to provide a wide range of financial products and services.

From mobile payment solutions to peer-to-peer lending platforms, these companies incorporate finance seamlessly into their existing platforms, improving convenience and accessibility for the users.

2. Data-Driven Insights and Personalization

With access to massive amounts of user data, Techfin companies leverage advanced analytics and algorithms of machine learning in order to gain valuable insights into customer behavior, financial needs, and preferences.

This enables them to deliver personalized financial products, customized experiences to users, and targeted recommendations, therefore it improves consumer engagement and satisfaction.

3. Diversification of Financial Offerings

Techfin companies go beyond conventional banking services in order to provide a detailed suite of financial offerings. It includes payment, lending, insurance, wealth management, and several others.

By diversifying their product portfolios, these companies create all-inclusive financial ecosystems that cater to the multifarious needs and requirements of the customers and businesses.

4. Global Reach and Market Penetration

The next characteristic of Tech-fin includes Global reach and market penetration. Operating on a global scale, these companies of Tech-fin expand their financial services across borders in order to reach millions of users worldwide.

Operating on a global scale, TechFin companies expand their financial services across borders, reaching millions of users worldwide.

No matter if it’s Alibaba’s financial affiliate, Ant Group, penetrating Southeast Asian markets or Google Pay expanding its footprint in Europe, these companies leverage their worldwide existence to capture new opportunities and gain market share.

5. Innovation and Disruption

Now, it is the time to discuss Innovation and disruption as it is another top-notch characteristic of Tech-fin. Technology finance flourishes on innovation and pushes the boundaries constantly of what is possible in the domain of finance.

No matter if it is exploring blockchain technology for secure transactions, incorporating AI-powered chatbots for providing customer support, or experimenting with cryptocurrency solutions, these companies drive disruption and redefine the booming future of finance.

5 Benefits of TechFin

When talking about technology finance, how can we ignore its benefits, isn’t it? So, let’s move together and learn some of the most popular benefits of Tech-fin in a broader way. These benefits are explained below comprehensively.

1. Improved Accessibility

Tech-fin companies provide users with improved and enhanced accessibility simply by making use of large-scale digital platforms and data analytics.

Technology finance enterprises are able to provide financial services to the underreserved segments at lower costs. For instance, making use of alternative data for credit scoring.

2. Enhanced Convenience

With the help of technology finance industries, people can incorporate financial tools into their already-using ecosystems, i.e., e-commerce, social media, and several others.

This provides users with more convenient money management. With this, transactions become easy, seamless, and hassle-free.

3. Personalization

You get personalization as another benefit under Tech Fin. It enables hyper-personalized offerings customized to specific financial behaviors, profiles, and goals.

It simply includes tailored investing portfolio mixes, payment plans, lending rates, and several others.

4. Streamlined Processes

Technology Finance streamlines the automated and effective digital processes for onboarding, transactions, underwriting, advisory, and several others.

It is powered by modern and contemporary technology that minimizes the paperwork and waiting time when compared with conventional or traditional finance.

5. Constant Innovation

Tech-fin companies offer constant innovation. The culture of these companies of rapid trial-and-error iteration and using top-notch and leading-edge technology, i.e., AI and Blockchain.

It encourages innovation and ingenious solutions of the latest financial product ideas and ventures on an ongoing and daily basis.

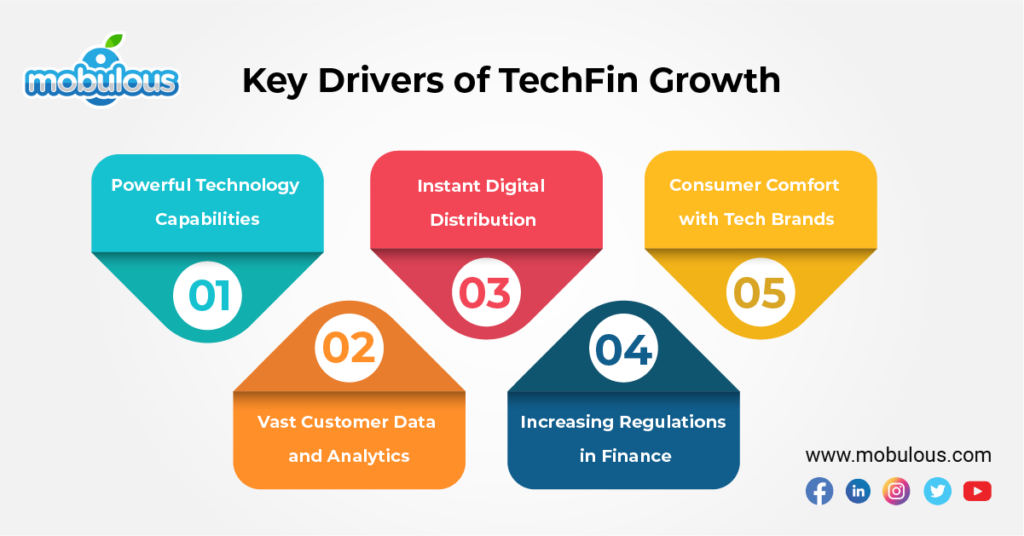

Key Drivers of TechFin Growth

Well, you will agree to the fact that Tech Fin is speeding ahead. It is driven by powerful and robust forces in order to increase its growth which you need to know.

From smartphone penetration to the rise of Artificial Intelligence, there are 5 key drivers that fuel the growth of Tech-fin. Get yourself ready to unlock the secrets of this financial revolution and see how it is reshaping your finances in the future.

1. Powerful Technology Capabilities

The first key driver of Tech-fin companies is the powerful technology capabilities in order to build optimized financial products simply by tapping the latest technologies such as:

- Artificial Intelligence and Machine Learning (AI/ML): Process groups of consumer data in order to render hyper-personalized, relevant offerings.

- Blockchain and Crypto: Facilitate decentralized, transparent financial transactions.

- Biometrics and Security: Authorize seamless, secure consumer onboarding and transactions.

2. Vast Customer Data and Analytics

Next is the vast consumer data and analytics. Under this, you must know that the vast amounts of search, messaging, purchase, and usage data from existing users are done here.

It permits granular consumer analysis in order to pre-approve credit, tailor the financing rates, and envision the income curves to risk profiles in a better and unique way.

3. Instant Digital Distribution

Global user bases number the billions of users across search, e-commerce, video, and messaging platforms.

These platforms authorize instant, cost-effective distribution of the latest financial offerings that are incorporated into the technology that is used on a daily basis.

4. Increasing Regulations in Finance

Another growth driver of tech fin is increasing regulations in finance under existing technology regulations.

Tech-fin services have faced less restrictive obstacles and hindrances that are related to reliable financial institutions that facilitate ingenious solutions at scale.

5. Consumer Comfort with Tech Brands

When we are embedded within platforms that are already trusted and enjoyed by the customers brings high engagement.

This brings technology finance companies to expand themselves into financial services seamlessly unlike those fintech companies that stand as a standalone challenger.

General Difference Between TechFin and FinTech

When we put it in simple language, we understand that although Tech-fin and Fin-tech sound similar, there is a huge difference between the two. Let’s move ahead and learn about the general difference between Tech-fin and Fintech.

FinTech is a general concept where the Finance company starts using technology in order to provide better customer support and ventures. However, Tech Fin solutions are where the technology context enters the finance domain in order to transform the interaction of the users with the company.

There are some examples of technology finance enterprises, including Google, Amazon, Facebook, and Apple, i.e., GAFA in the USA and Baidu, Alibaba, and Tencent, i.e., BAT in China.

Also Check: TechFin vs Fintech: The Future of Finance is Here!

The Bright Future of TechFin in 2024 and Beyond

Let’s step ahead and discuss the future of Tech-fin and how it has the potential to change the way people conduct financial transactions in the forthcoming years. Well, this robust technology amalgamates conventional financial services with top-notch technologies such as blockchain and artificial intelligence.

Therefore, banks and other financial enterprises and organizations are stepping ahead to explore and adopt technology finance in their operations.

These modifications will permit them to stay in front of the queue of competitors in today’s ongoing and ever-changing landscape of the financial industry. However, there are several potential apps for technology finance.

For illustration, it can streamline cross-border payments, enhance customer support, and minimize fraudulent activities. In addition to this, tech fin can be used to provide the latest type of financial services, such as peer-to-peer lending and micro-insurance.

When talking generally, the potential of Tech-fin and its forthcoming impact is exciting, and it can modify the financial industry completely.

As more and more banks and financial institutions adopt and adjust their businesses with this latest technology, we are most likely to see a substantial drift towards digital banking and a more compelling customer-centric financial system.

Final Talk

Last but not least, TechFin is constantly moving ahead with lightning speed gaining prosperous success in the frequently evolving world. In today’s landscape, when everyone is busy in their lives, Tech-fin is there to save their finance brilliantly.

However, fintech was always there to help innumerable people with their money but with its disruptive forces Tech-fin has made a significant uproar within the financial services businesses. If conventional businesses want to survive this digital revolution, then they need to digitize their corporate structures immediately.

FAQs About Techfin

Q. What is Tech-Fin?

Ans. Tech-fin or Technology finance refers to established tech companies such as Google. Amazon, or Apple, offers financial services as an elongation of their core offerings. They leverage their current technology and user data in order to facilitate and incorporate financial activities within their established ecosystems.

Q. What are the benefits of Tech-Fin?

Ans. Some of the most popular benefits of Tech-Fin include the following:

- Improved Accessibility

- Enhanced Convenience

- Personalization

- Streamlined Processes

- Constant Innovation

Q. How is Tech-Fin different from Fintech?

Ans. FinTech companies generally concentrate on delivering ingenious solutions for financial services with the help of technology whereas Tech-fin companies add financial services as a supplementary trait to their core offerings. Technology finance leverages current user data whereas Fintech usually builds its user base from the start.

Visit Mobulous for App Development Services

Mail