What is a Loan Lending App?

A loan lending application is a digital platform that fosters financial transactions by connecting borrowers with lenders through mobile technology.

It simplifies the overall loan app process, from initial inquiry to fund disbursement, utilizing sophisticated algorithms, real-time verification systems, and secure payment gateways for individuals and businesses.

Benefits of Loan Lending App Development

Loan lending app development revolutionizes financial services by introducing innovative technological solutions that transform traditional lending processes and improve user experience across multiple financial segments. Below are the crucial benefits of loan lending app development:

1. Enhanced Accessibility

Borrowers can access financial services 24/7 from anywhere, eradicating geographical constraints, reducing paperwork, and providing quick loan app submissions through user-friendly mobile interfaces with seamless digital interactions.

2. Faster Approval Process

Advanced algorithmic systems enable quick credit assessments, real-time risk evaluation, and automated document verification that significantly reduce loan processing times from weeks to minutes.

3. Transparent Financial Operations

Digital platforms offer comprehensive loan tracking, clear fee structures, transparent communication channels, and detailed transaction histories that ensure complete financial visibility for users.

4. Personalized Loan Recommendations

Savvy machine learning algorithms examine individual financial profiles, suggesting optimal borrowing options, generating tailored loan offers, and matching users with highly suitable financial products.

5. Cost-Effective Solutions

Automated processes reduce operational expenses, reduce manual interventions, enable competitive interest rates, and lower administrative costs for borrowers through streamlined digital infrastructure.

6. Advanced Security Mechanisms

Robust encryption technologies, secure payment gateways, multi-factor authentication, and continuous monitoring safeguard confidential financial information and prevent potential fraudulent activities.

How Do Loan Lending Apps Work?

Loan lending applications leverage advanced technological ecosystems that integrate multiple financial services, secure infrastructure, and comprehensive verification mechanisms in order to foster seamless borrowing experiences across digital platforms.

These innovative mobile apps create effective, seamless, and user-friendly borrowing experiences, integrating multiple financial technologies in order to simplify loan processing, fund disbursement, and risk assessment with unparalleled accuracy and speed.

Let’s understand the key operational steps of loan lending applications carefully:

- User profile creation with comprehensive personal and financial information verification.

- Automated credit scoring using advanced machine learning and predictive analytics algorithms.

- Real-time loan eligibility assessment through intelligent risk evaluation technologies.

- Personalized loan offer generation based on individual financial background analysis.

- Digital documentation processing with secure and encrypted transaction management systems.

- Instant fund disbursement and seamless repayment tracking through integrated payment gateways.

Different Types of Mobile Loan Lending Apps

Mobile loan lending applications represent financial solutions that cater to specific market segments, offering targeted lending experiences addressing exceptional borrower requirements and financial objectives and goals. The different types of mobile loan lending apps are mentioned below:

1. Student Loan Apps

Student loan apps are specialized platforms that are specifically designed for educational financing, offering flexible repayment options, extended moratorium periods, lower interest rates, and streamlined app processes specifically customized for students pursuing higher education.

2. Digital Credit Card Apps

Digital credit card applications are ingenious mobile apps that provide quick credit card issuance, reward management, seamless integration with banking ecosystems, real-time spending tracking, and personalized credit limits with banking ecosystems for enriched financial control.

3. Business Loan Apps

Business loan applications are comprehensive financial platforms that support entrepreneurial ventures by offering instant business financing, industry-specific loan lending solutions, flexible loan structures, and simplified app processes for small and medium enterprises.

4. Loan Aggregator Apps

Loan aggregator apps are centralized digital platforms that compare multiple loan products, presenting comprehensive financial options, offering side-by-side comparisons, providing clear and transparent interest rates, and helping users make informed borrowing decisions.

5. Personal Loan Apps

User-centric mobile apps enable quick personal loan approvals, offer tailored financial solutions, support diverse personal expenditures, and provide instant fund disbursement with minimal documentation.

6. Auto Loan Apps

Auto loan apps are specialized mobile platforms that foster vehicle financing, offering quick loan approvals, providing competitive interest rates, supporting vehicle documentation, and allowing for seamless automotive financing experiences.

7. Microloan Apps

Microloan apps are digital platforms that provide small-scale financial assistance, support low-value loans, enable quick disbursement, target underserved market segments, and promote financial inclusion for individuals with limited access.

8. Mortgage Loan Apps

Mortgage loan apps are comprehensive mobile apps that streamline property financing, offering detailed mortgage calculations, providing real-time interest rate comparisons, supporting document verification, and streamlining home loan acquisition processes.

9. Peer-to-Peer Lending Apps

Innovative platforms connect individual lenders and borrowers directly, eradicate traditional banking intermediaries, offering competitive interest rates, and fostering transparent financial transactions through digital ecosystems.

10. Payday Loan Apps

Payday loan applications are short-term financial solution apps that provide quick cash advances, support emergency financial necessities, offer quick approval processes, and enable rapid fund transfers for quick monetary requirements.

How to Create a Loan Lending App From Scratch?

Building a successful loan lending application requires comprehensive strategic planning, deep understanding, and technological expertise of financial service requirements, combining ingenious design with robust technological infrastructure for successful implementation. Below are the comprehensive steps that will help you create an advanced loan lending application from scratch:

1. Market Research and Requirement Analysis

Conduct thorough market research, examine existing loan lending apps, identify target audience segments, understand user pain points, evaluate competitive landscapes, and define specific functional and technological necessities for the proposed mobile app.

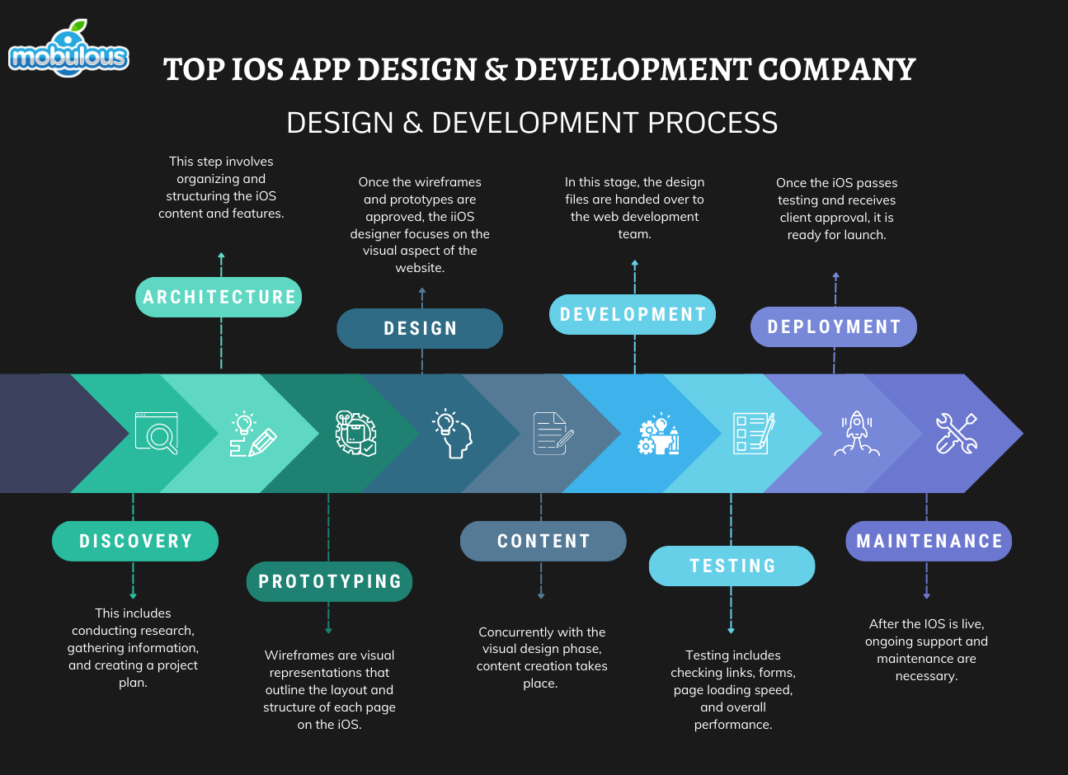

2. Design User Experience and Interface

Develop intuitive and user-centric interface design, build wireframes and prototypes, focus on seamless navigation, and enforce responsive design principles.

Prioritize visual clarity and streamlined user interaction flows and ensure accessibility across diverse devices.

3. Technology Stack Selection

Select the right technology stack, programming languages, frameworks, and development tools, considering scalability, security requirements, performance, and future technological adaptability.

Choose robust back-end infrastructure and front-end technologies supporting comprehensive loan lending app development.

4. Development and Implementation

Create modular application architecture, enforce sophisticated features, including automated credit scoring, build savvy risk assessment algorithms, integrate secure payment gateways, and create comprehensive back-end systems supporting seamless loan processing and management.

5. Security and Compliance Integration

Enforce multilayered security protocols, ensure regulatory compliance, integrate advanced encryption technologies, and build robust authentication mechanisms.

Protect sensitive financial information and maintain comprehensive data protection standards throughout the loan lending application.

6. Testing, Deployment, and Maintenance

Conduct rigorous functional and performance testing, validate app reliability, develop continuous monitoring, systems, establish long-term maintenance and support, and perform security audits for sustained operational excellence.

Key Features of Loan Lending App Development

Loan lending app development requires incorporating advanced technological features that improve user experience, simplify financial processes, and provide comprehensive digital lending solutions across multiple functional domains. The crucial features that your loan lending apps should contain are explained below one by one:

1. Chat Support

Implement real-time customer support channels, integrate savvy chatbots, enable secure communication interfaces, provide quick query resolution, create personalized assistance mechanisms, and offer multilingual support for seamless user interaction and problem-solving.

2. Document Management

Develop comprehensive digital document storage systems, enable secure file uploads, implement automated verification processes, support multiple document formats, provide intuitive document organization interfaces, and ensure encrypted data management for sensitive financial documentation.

3. Reports and Analytics

Create advanced reporting dashboards, generate detailed financial insights, visualize loan performance metrics, track user borrowing patterns, provide comprehensive data analysis tools, and offer actionable financial intelligence for both users and administrators.

4. Integration of Cloud Storage

Implement secure cloud storage solutions, ensure scalable data management, provide seamless document synchronization, enable remote access, maintain robust backup systems, and create reliable, flexible infrastructure for storing sensitive financial information.

5. Regular Repayments

Develop automated repayment tracking systems, generate intelligent payment reminders, support multiple payment methods, create flexible repayment schedules, enable automatic installment deductions, and provide comprehensive loan management functionalities.

6. Easy Loan Calculation

Integrate sophisticated loan calculation algorithms, provide real-time interest rate simulations, generate instant EMI projections, support multiple loan types, create user-friendly calculation interfaces, and offer transparent financial planning tools.

7. Convenient Payment Plans

Design flexible payment structures, support customizable repayment options, enable multiple installment configurations, provide adaptive payment scheduling, create user-centric financial management tools, and support diverse borrower financial preferences.

8. Transaction Record

Maintain comprehensive digital transaction histories, provide detailed financial logs, generate downloadable statements, ensure transparent record-keeping, support transaction categorization, and create intuitive financial tracking mechanisms for users.

Does The Loan Lending App Include Features Like EMI Calculators Or Interest Rate Simulations?

Modern loan lending applications typically incorporate advanced financial calculation tools, including sophisticated EMI calculators and comprehensive interest rate simulation features.

These integrated technologies enable users to accurately project loan costs, understand potential financial commitments, and make informed borrowing decisions through interactive and user-friendly digital interfaces.

Right Technology Stack For Loan Lending App Development

Selecting the right technology stack for a loan lending app development is essential to ensure scalability, security, efficiency, and a seamless user experience. Let’s understand the crucial technology stack with a quick breakdown for better clarity:

1. Frontend Development (User Interface)

- Purpose: To create a user-friendly and intuitive interface for borrowers and lenders.

- Technologies:

- React.js: React.js is known for its component-based architecture and fast rendering.

- Angular: Angular is used for building dynamic and robust single-page applications (SPAs).

- Vue.js: Vue.js is a lightweight framework for interactive UI development.

- Swift (iOS) and Kotlin (Android): Swift (iOS) and Kotlin (Android) are used for native app development for platform-specific high performance.

2. Backend Development (Server-Side Logic)

- Purpose: To manage data processing, transactions, and business logic securely.

- Technologies:

- Node.js: Node.js is a high-performance for handling real-time data and asynchronous processes.

- Python with Django/Flask: Python with Django/Flask is a secure and quick-to-develop financial solution.

- Java with Spring Boot: Java with Spring Boot is known for scalability and enterprise-level applications.

- Ruby on Rails: Ruby on Rails is used for rapid application development.

3. Database Management

- Purpose: To securely store user and transaction data.

- Technologies:

- MySQL: A relational database for structured data.

- PostgreSQL: Supports complex queries and ACID compliance.

- MongoDB: A NoSQL database for unstructured data and faster access.

- Redis: For caching and real-time analytics.

4. Mobile Development Frameworks

- Purpose: To provide a seamless mobile experience.

- Technologies:

- React Native: React Native is a cross-platform mobile app development with native-like performance.

- Flutter: The Flutter app development framework is ideal for building high-performing apps with a single codebase.

5. Cloud Infrastructure

- Purpose: To ensure scalability, reliability, and uptime.

- Technologies:

- AWS (Amazon Web Services): Provides scalable and secure hosting solutions.

- Google Cloud Platform (GCP): Offers robust cloud computing services.

- Microsoft Azure: Known for integration with enterprise systems.

6. Payment Gateway Integration

- Purpose: To enable seamless and secure transactions.

- Options:

- Stripe

- PayPal

- Razorpay

- Braintree

7. Authentication and Security

- Purpose: To protect sensitive financial and personal data.

- Technologies:

- OAuth 2.0: For secure user authentication.

- JWT (JSON Web Tokens): For stateless and secure data transmission.

- SSL/TLS: To encrypt data in transit.

- Two-Factor Authentication (2FA): Adds an additional security layer.

8. APIs and Integrations

- Purpose: To connect with third-party services.

- Examples:

- Plaid or Yodlee: For financial data aggregation.

- Experian or Equifax APIs: For credit score checking.

- Machine Learning APIs: For fraud detection and predictive analysis.

9. DevOps Tools

- Purpose: To streamline deployment and maintain app performance.

- Technologies:

- Docker: For containerization.

- Kubernetes: For orchestrating containerized applications.

- Jenkins: For continuous integration and delivery (CI/CD).

- Git: For version control.

10. Analytics Tools

- Purpose: To monitor and analyze user behavior.

- Technologies:

- Google Analytics: For user insights.

- Mixpanel: For tracking user interactions.

- Firebase Analytics: For mobile app-specific analytics.

How Can ML Models Be Integrated For Credit Risk Assessment And Fraud Detection?

Machine Learning models revolutionize credit risk assessment and fraud detection by utilizing advanced algorithms, savvy data processing, and predictive analytics techniques in financial technology applications. Let’s understand how can ML models be integrated for credit risk assessment and fraud detection:

1. Predictive Credit Scoring Algorithms

Implement sophisticated machine learning models that analyze multiple data points, including financial history, transaction patterns, social media insights, and behavioral indicators to generate comprehensive and dynamic credit risk profiles.

2. Anomaly Detection Techniques

Develop advanced neural network models that identify unusual transaction patterns, detect potentially fraudulent activities in real-time, create intelligent risk flagging systems, and generate immediate alerts for suspicious financial behaviors.

3. Behavioral Pattern Recognition

Utilize deep learning algorithms to analyze user interaction patterns, track historical financial behaviors, create personalized risk assessment models, and develop intelligent prediction mechanisms for loan default probability.

4. Multi-Dimensional Risk Scoring

Design comprehensive machine learning frameworks that integrate multiple risk assessment parameters, combine diverse data sources, generate holistic risk evaluation models, and provide nuanced credit risk predictions.

5. Real-Time Fraud Prevention

Implement intelligent machine learning models that continuously monitor financial transactions, detect potential fraudulent activities instantly, create adaptive security mechanisms, and prevent unauthorized financial interactions.

6. Adaptive Learning Systems

Develop self-improving machine learning models that continuously learn from new data, update risk assessment algorithms, improve prediction accuracy, and adapt to emerging financial behavior patterns.

What Platforms Does The Loan Lending App Support?

Modern loan lending applications prioritize comprehensive platform compatibility, ensuring seamless user experiences across multiple digital environments and supporting diverse technological ecosystems.

1. iOS Platform Support

Develop native iOS applications with optimized performance, leveraging Swift programming language, implementing Apple ecosystem guidelines, ensuring seamless integration with iPhone and iPad devices, supporting the latest iOS versions, and providing smooth user experience.

2. Android Platform Support

Create robust Android applications using Kotlin and Java, ensuring compatibility across multiple device manufacturers, supporting various screen sizes, implementing material design principles, and providing consistent functionality across different Android operating system versions.

3. Web Application Platform

Design responsive web applications using modern frontend frameworks, implementing progressive web app technologies, ensuring cross-browser compatibility, supporting desktop and mobile web environments, and providing seamless user interactions.

4. Cross-Platform Development

Utilize advanced cross-platform development frameworks like React Native and Flutter, enabling a unified codebase, reducing development complexity, ensuring consistent user experience across multiple platforms, and accelerating application deployment.

5. Responsive Design Implementation

Develop flexible user interfaces that automatically adapt to different screen sizes, resolutions, and device orientations, ensuring optimal visual presentation and functionality across smartphones, tablets, and desktop environments.

Which Third-Party APIs Are Required For The Loan Lending App?

Integrating third-party APIs is crucial for enhancing loan lending application functionality, providing comprehensive financial services, and ensuring robust technological infrastructure across multiple operational domains. The most essential third-party APIs that are required for the loan lending application are mentioned below:

1. Credit Score and Financial Verification APIs

Implement advanced credit scoring APIs that retrieve comprehensive financial histories, validate user credit profiles, access real-time credit reports, integrate multiple credit bureau data sources, and provide detailed financial risk assessments.

2. Payment Gateway Integration APIs

Incorporate secure payment gateway APIs supporting multiple transaction methods, enabling seamless financial transfers, implementing robust encryption protocols, supporting international and domestic payment processing, and ensuring smooth fund disbursement mechanisms.

3. Document Verification APIs

Integrate intelligent document verification APIs that support automated identity validation, enable real-time documentation scanning, extract critical information, verify government-issued identifications, and provide comprehensive authentication mechanisms.

4. KYC and Compliance APIs

Implement Know Your Customer (KYC) APIs supporting comprehensive user verification, enabling automated regulatory compliance checks, accessing government databases, validating user identities, and ensuring adherence to financial regulatory standards.

Can The Loan Lending Mobile App Handle Both Secured And Unsecured Loans?

Modern loan lending mobile applications are designed to support comprehensive loan management capabilities, including both secured and unsecured loan types.

These sophisticated platforms incorporate advanced risk assessment algorithms, flexible documentation processes, and intelligent verification mechanisms to handle diverse loan categories.

The application's adaptable architecture enables seamless integration of various loan products, accommodating different collateral requirements and financial scenarios while maintaining robust security protocols and user-friendly interfaces.

What Personal And Financial Details Are Required For Registration?

Loan lending app registration processes require comprehensive user information collection, balancing detailed financial profiling with user privacy protection and regulatory compliance requirements. Below are the personal and financial details that are highly required for registration in the loan lending application:

1. Personal Identification Information

Collect essential personal details including full legal name, date of birth, government-issued identification numbers, residential address, contact information, and comprehensive demographic profile for accurate user verification.

2. Employment and Income Details

Gather comprehensive employment information, including current job profile, monthly income, employment stability, professional experience, employer details, salary slips, and additional income sources for financial assessment.

3. Financial Account Information

Capture critical financial account details, including bank account numbers, account types, income statements, existing financial obligations, credit history, and comprehensive transactional background for risk evaluation.

4. Contact and Communication Preferences

Collect primary and secondary contact information, email addresses, phone numbers, preferred communication channels, communication consent, and emergency contact details for seamless user interaction.

5. Digital Documentation Upload

Enable secure digital documentation upload functionality, supporting multiple file formats, allowing users to submit income proof, identity verification documents, address proof, and additional financial supporting materials.

Can Users Check Their Loan Eligibility Within The Loan Lending App?

Modern loan lending applications provide comprehensive loan eligibility checking mechanisms directly within the mobile platform.

These sophisticated tools integrate advanced algorithms, analyze user-provided financial information, generate instant eligibility assessments, and offer personalized loan recommendations.

Users can quickly understand their potential borrowing capacity, receive real-time feedback, and explore suitable loan options through intelligent, user-friendly interfaces.

Does The Loan Lending App Provide Real-Time Loan Status Updates?

Advanced loan lending applications offer comprehensive real-time loan status tracking capabilities. These sophisticated platforms provide instant notifications, detailed progress updates, and transparent communication channels throughout the entire loan lifecycle.

Users can access current application stages, receive immediate status changes, track document verification processes, monitor approval progress, and obtain comprehensive insights into their loan journey through intuitive digital interfaces.

How Does The Loan Lending App Ensure The Security Of Users' Personal And Financial Information?

Modern loan lending applications implement multilayered security protocols to protect user information. These sophisticated systems utilize advanced encryption technologies, secure authentication mechanisms, biometric verification, end-to-end data protection, continuous monitoring systems, and robust compliance frameworks.

Multiple security checkpoints, including two-factor authentication, secure cloud storage, and intelligent threat detection algorithms, ensure comprehensive protection of sensitive personal and financial data.

Is Two-Factor Authentication Supported For User Accounts?

Modern loan lending applications implement robust two-factor authentication systems to enhance account security and protect sensitive financial information.

This advanced security mechanism requires users to verify their identity through multiple authentication channels, typically combining a password with a secondary verification method like SMS codes, authenticator apps, biometric verification, or email confirmation.

The multi-layered approach significantly reduces unauthorized access risks, providing comprehensive protection against potential security breaches and ensuring users' financial data remains completely secure.

What Payment Methods Does The Loan Lending App Support For Loan Repayment?

Loan lending applications offer diverse payment methods to accommodate various user preferences and financial capabilities, ensuring convenient and flexible repayment options. The robust payment methods that loan lending application supports for loan repayment are mentioned below:

- Direct bank account electronic fund transfers

- Credit and debit card payment options

- Mobile wallet integrated payment systems

- Net banking digital payment channels

- Unified Payment Interface (UPI) transactions

- Automated recurring payment configurations

Are Automated Payment Reminders Available?

Loan lending applications integrate sophisticated notification systems that provide automated payment reminders through multiple communication channels.

These intelligent platforms send timely alerts via SMS, email, and in-app notifications, helping users track upcoming EMI deadlines, prevent potential late payment penalties, and maintain consistent financial discipline.

The proactive reminder system ensures users stay informed about their loan repayment schedules, reducing the risk of unintentional defaults and supporting responsible financial management.

Can Users Set Up Autopay For Their EMIs?

Advanced loan lending applications offer comprehensive autopay features, enabling users to configure automatic EMI payments directly from their linked bank accounts.

This convenient functionality allows seamless, scheduled loan repayments, eliminating manual intervention, preventing missed payments, and ensuring consistent financial compliance.

Users can customize autopay settings, set preferred dates, and maintain complete control over their loan repayment processes.

Cost of Loan Lending App Development

Loan lending app development costs range between $20,000 to $100,000, depending on complexity, features, platform compatibility, technological sophistication, and the expertise of the loan lending app development company.

Factors influencing pricing include advanced security protocols, machine learning integration, multiple platform support, and customized financial algorithmic requirements. Development expenses vary based on project scope and technological complexity.

Timeline of Loan Lending App Development

Loan lending app development typically spans 4 to 9 months, encompassing comprehensive stages including market research, design, development, testing, and deployment.

Initial planning requires 1 to 2 months, core development consumes 3 to 4 months, testing and refinement take 1 to 2 months, with the final launch and initial support completing the comprehensive development cycle.

Benefits of Partnering With the Top Loan Lending App Development Company

Selecting a top-rated loan lending app development company provides strategic advantages, combining technological expertise, innovative solutions, and comprehensive financial technology capabilities for successful digital lending platform implementation. Below are the key benefits of partnering with the top loan lending app development company:

1. Advanced Technological Expertise

By hiring a leading loan lending app development company, you can access cutting-edge technological solutions, leveraging sophisticated machine learning algorithms, intelligent risk assessment frameworks, and comprehensive digital transformation strategies specifically tailored for modern financial technology ecosystems.

2. Comprehensive Security Implementation

A loan lending app development company benefits from robust multilayered security protocols, advanced encryption technologies, intelligent fraud detection mechanisms, and comprehensive compliance frameworks ensuring maximum protection of sensitive financial information and user data.

3. Customized Solution Architecture

By partnering with a robust loan lending app development company, you can receive fully customizable loan lending application designs addressing specific business requirements, supporting unique operational workflows, and creating scalable technological infrastructures aligned with organizational strategic objectives.

4. Continuous Innovation and Support

By seeking help from an advanced loan lending app development company, you will obtain ongoing technological support, regular application updates, advanced feature integrations, performance optimization strategies, and continuous improvement mechanisms ensuring long-term technological relevance and competitive advantage.

5. Regulatory Compliance Management

Partner with a premier loan lending app development company and leverage expert knowledge of complex financial regulations, ensuring seamless adherence to regional and international compliance standards, implementing comprehensive regulatory frameworks, and mitigating potential legal risks.

6. Cost-Effective Development Strategies

A notable loan lending app development company can help you optimize development investments through efficient technological approaches, reducing overall implementation costs, minimizing long-term maintenance expenses, and delivering high-quality loan lending application solutions within budgetary constraints.

Tips to Partner With the Right Loan Lending App Development Company

Choosing the right loan lending app development company requires comprehensive research, careful evaluation, and strategic assessment of technological capabilities, alignment with organizational objectives, and industry expertise. Let’s learn the key tips that will help you partner with the right loan lending app development company:

1. Evaluate Technological Portfolio

Thoroughly examine previous technological projects, assess development portfolios, review case studies, analyze complex implementation examples, and validate the loan lending app development company's technical expertise in financial technology solutions.

2. Verify Industry Experience

Investigate the loan lending app development company's specific experience in loan lending app development, understand domain-specific knowledge, evaluate financial technology understanding, and assess previous successful implementation strategies in similar technological environments.

3. Assess Security Capabilities

Thoroughly examine security protocols, investigate encryption methodologies, verify compliance frameworks, analyze fraud detection mechanisms, and validate comprehensive data protection strategies implemented by the potential loan lending app development company.

4. Understand Customization Potential

Evaluate the loan lending app development company's ability to create tailored solutions, assess flexibility in addressing unique requirements, examine modular development approaches, and verify capacity for comprehensive technological customization.

5. Check Ongoing Support Mechanisms

Investigate post-development support strategies, verify maintenance commitments, assess update frequencies, examine technical support frameworks, and validate long-term technological partnership potential with the loan lending app development company.

6. Analyze Cost-Effectiveness

Compare development cost structures, evaluate pricing models, assess value propositions, examine the potential return on investment, and validate comprehensive financial implications of the potential loan lending app development company.

7. Validate Communication Processes

Assess communication effectiveness, examine project management methodologies, verify transparency levels, evaluate collaborative frameworks, and ensure smooth information exchange throughout the development processes of the loan lending app development company.

Contact us

Contact us